When I speak to founders with an advisory/consultancy business who want to grow their SaaS, one question always comes up: how would we fund it?

To my mind there are three stages (always good to break it down into smaller, less daunting chunks!). Depending on where you are in the journey, will determine how you approach it. I’m going to talk through them and hope to make them seem less scary and impossibly overwhelming than they might seem at first.

Stage 1 - Pre-MVP/Idea

You have an idea or some ideas and you are starting to validate them. You’re probably doing them on the side, or in your down time. When I had an agency, we normally had one or two product initiatives on the go and if we had a bit of a quieter month we might get a designer to work on the UI or some devs to hack on another part of the product. We didn’t need to think about funding for this as we were paying people’s salaries anyway - we were just getting them to put a bit of effort into a new idea when time allowed. This is one of the advantages you have being an agency/consultancy owner looking to start a product. You can do all of that preliminary prototyping and validation without breaking a sweat.

Stage 2 - Early-stage commercial launch

You’ve launched the product. People can find you and pay for it. The trouble is that with SaaS, typically the early months are slow in terms of revenue contribution. So, yeah you might be growing 200% a month, but if month 1 is $50, then doubling or tripling in size in month 2 isn’t exactly going to move the needle (yet!).

But nevertheless, the product is out there and people are using it and paying for it. This is the danger zone in many ways because you are probably going to need the income of your agency/consultancy to pay for the costs of running and growing your nascent SaaS business. You end up juggling two things and with that comes a lack of focus which will hold you back on both sides.

My advice here, and what we did, was allocate a fixed resource for what you need until you get to Stage 3, rather than relying on ‘downtime'. It’s a balancing act of course, the more you allocate the faster you will get there, but if you ignore all of your agency clients they will quickly stop paying you and if you ignore your new SaaS customers, they aren’t going to hang around either. Work out what the product needs and what you can afford. This might be a full-time developer and a full-time commercial person. In our case, of the three founders, two of us moved full-time to our SaaS and we also had 5 or 6 developers. We weren’t messing about. But each business will be different.

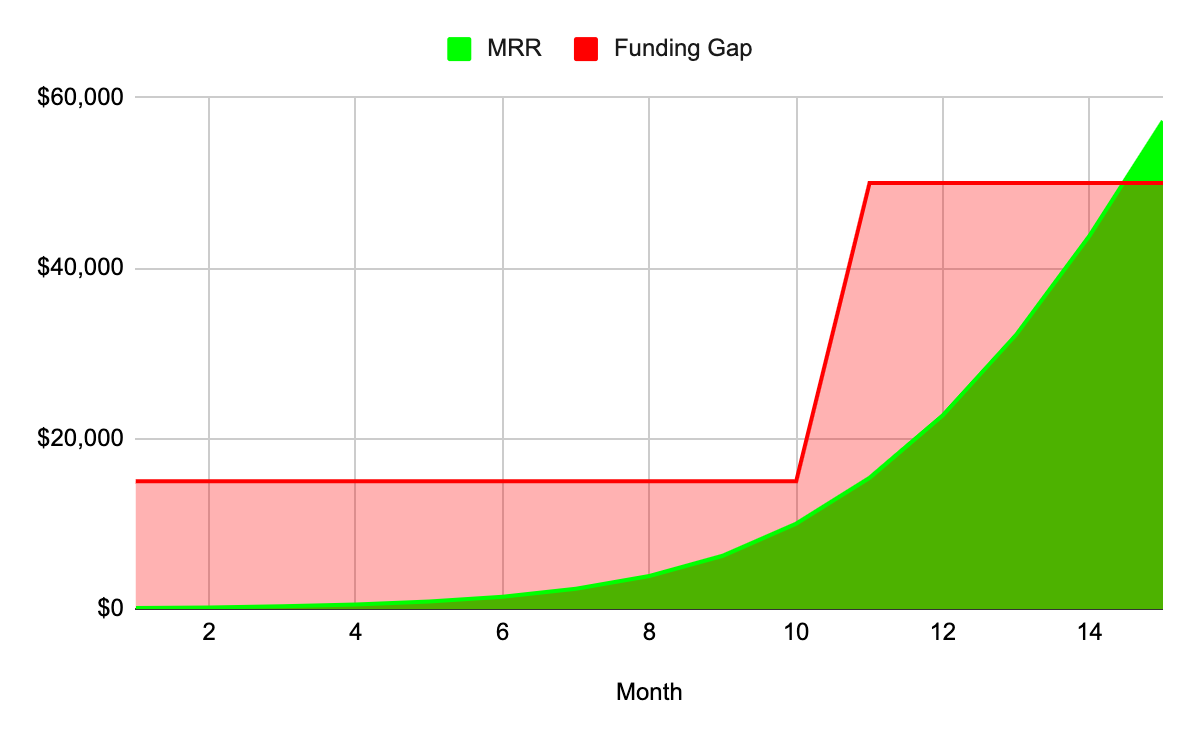

You then need to work out the Funding Gap between now and Stage 3. Let’s imagine you commit $15k/month to your SaaS that can be paid out of agency margins and a bit of savings. You then need to look at your forecasts for revenue which let’s say for arguments’ sake you think will go from $100/month today, to $10k/month in the next 10 months (this is what happened to us). You might see a chart like the one below.

As you can see, as your revenue grows, it is offset against your monthly costs of $15k. Just FYI. the total size of this funding gap in this hypothetical example is about $125k. Could you fund that out of margin and savings over the next 10 months? If so, then there’s your answer. And if at any time in the next 10 months revenue doesn’t grow then you can stop or pause or whatever. Would you be prepared to pay $125k to have a $120k ARR business in 10 months’ time?

(By the way I know that based on this hypothetical all you need to do is keep going another few months and you’re funding problems are solved as the green line will catch up and overtake the red. The reality is that it is unlikely your costs will remain steady if your revenue us rising like this - see Stage 3.)

The main point here is that this approach gets you to $10k/month and at that point you should feel confident enough to make a choice: carry on like this and stay at Stage 2, or make the transition from Agency to SaaS if that’s what you want to do. There are lots of reasons why you should make the transition. The main one being focus. We launched a number of products but without that founder focus, they all plateaued at somewhere between $5k and $30k/month. It wasn’t until we properly focused on ScreenCloud that we were able to scale it to $1m in 18 months.

But the dilemma here is that focus means giving something up. And giving up revenue is counter-intuitive. Time for Stage 3.

Stage 3 - Transition to SaaS

“But my agency is doing $1m a year and my SaaS is only doing $100k - I’d be mad to turn away something that is ten times bigger to focus on my SaaS.”

And yes, you’re not wrong. But you also have to just step back a bit and think about this slightly differently. I’m going to make lots of assumptions here which may or may not resonate with your situation, but some of them hopefully will and make this make sense.

$1m a year in consultancy revenue with what margins? 10%? 5%? 0% once you’ve paid yourselves? Let’s assume founders’ salaries/dividends equate to $200k and nothing is left from the million at that point.

That means that what you’re really ‘giving up’ is $200k not $1m. The $800k is just what you make to pay people and keep the lights on at the agency. But if you’re planning on transitioning to SaaS you won’t need to pay this anymore. The whole ‘turnover is vanity, profit is sanity’ maxim is at play here. You’re really holding your SaaS future back over $200k (or whatever it is), not your entire turnover.

Let’s also say that to run a lean SaaS team on a $100k Annual Recurring Revenue is another $34k/month. So with your founder salaries and the running costs to begin with we need $50k/month. Sounds scary right? $50k costs/month with nothing coming in.

But remember that’s not $50k loss. By this point we already have $10k in Monthly Recurring Revenue and you have a growth trajectory that is starting to look pretty interesting.

If we run the same scenario as in Stage 2 but this time starting from month 10 and including the new higher costs, what could that funding gap look like now?

Accepting that these are all hypothetical numbers. the funding gap is the area of red, which in this example only equates to about $90k until we’re breaking even.

So, if we look at the whole journey from commercial launch, which is when we started investing real money for our SaaS, the entire period would look like this (with month 10 being when the decision to focus on SaaS began):

The point here is that dropping the agency and instead funding a SaaS isn’t quite the loss that we might first imagine. These revenue numbers are a fairly accurate reflection of our MRR growth, but our costs were a lot higher. You would need to work out what your likely costs would be if you wanted to do the same thing.

But.. the key thing is that this exercise gives you an idea of your Funding Gap. In this example, the total red area comes to $210k. I’m not saying that yours would be $210k, all I’m saying is that $210k seems way less scary than $1.25m’s worth of lost revenue plus another $750k+ of costs over 15 months.

A route, then, could be to work out what a realistic number is for you to get to, say $42k/month in MRR ($500k ARR). If you can bootstrap your way there then great, if not, you go for angel investment to get you to that half a million milestone.

Then have the plan that once you’re at $500k you can either have credible conversations with VC investors or you try and operate as close to profitability as you can (like you do as an agency).

I’m not going to jump off a cliff based on hypotheticals

I know I know. It’s never as simple as this. But in our case, we followed this three stage approach: we put about $200k in ourselves and raised investment for the rest. We also sold our agency and kept that money as founders personally. If you’re interested in working out whether this could apply to your business, I’m here to help. Otherwise hopefully this will be of some value if you’re thinking about doing it yourself.